Demand estimation has many benefits when it comes to inventory management. With accurate estimations, businesses can better anticipate customer demand and adjust production accordingly. Proper estimation helps minimize the risk of stock-outs or overstocking by working to predict future customer needs and adjust inventory levels. This allows businesses to gain maximum returns from their inventory investments while avoiding costly losses due to excess inventory costs or dealing with production downtime issues.

Despite advantages, there are challenges to executing demand estimation well. Demand estimates are often based on assumptions and predictions meaning that errors or inaccuracies can occur. For instance, demand estimation can be difficult due to the complexity of demand patterns in manufacturing. Issues can also arise with changing customer tastes, cyclicalities of demand, or industry requirements. Considering these aspects, demand forecasting requires careful analysis and timely updates which can be challenging for businesses to keep up with.

Interdepartmental Buy-in

Demand estimation is a collaborative process that involves the input and expertise of various departments across the organization. Each group contributes important information to the process.

Executive leadership sets the strategic direction, including growth targets and market expansion plans, which guide the overall demand estimation process. They also assess risks related to market volatility and competition, ensuring that forecasts are aligned with the company’s strategic objectives. The legal department monitors regulatory changes and contractual obligations, ensuring that demand forecasts consider any potential legal or compliance issues.

On the demand side of the process, the sales and marketing teams play a crucial role by providing insights into historical sales data, market trends, and customer preferences. They also share feedback from direct customer interactions, which helps in anticipating shifts in demand. The finance department contributes by analyzing economic indicators, setting sales targets, and assessing the cost implications of different demand scenarios, ensuring that forecasts align with the company’s financial goals.

The organization’s capacities and external support for meeting demand are provided by production managers and purchasing teams. Supply chain and procurement teams provide information on inventory levels, supplier capabilities, and logistics constraints, which are essential for aligning production with demand. They also monitor supplier performance and potential disruptions that could impact material availability. Operations and production teams add value by offering insights into manufacturing capacity, production lead times, and efficiency metrics, ensuring that demand forecasts are realistic and achievable.

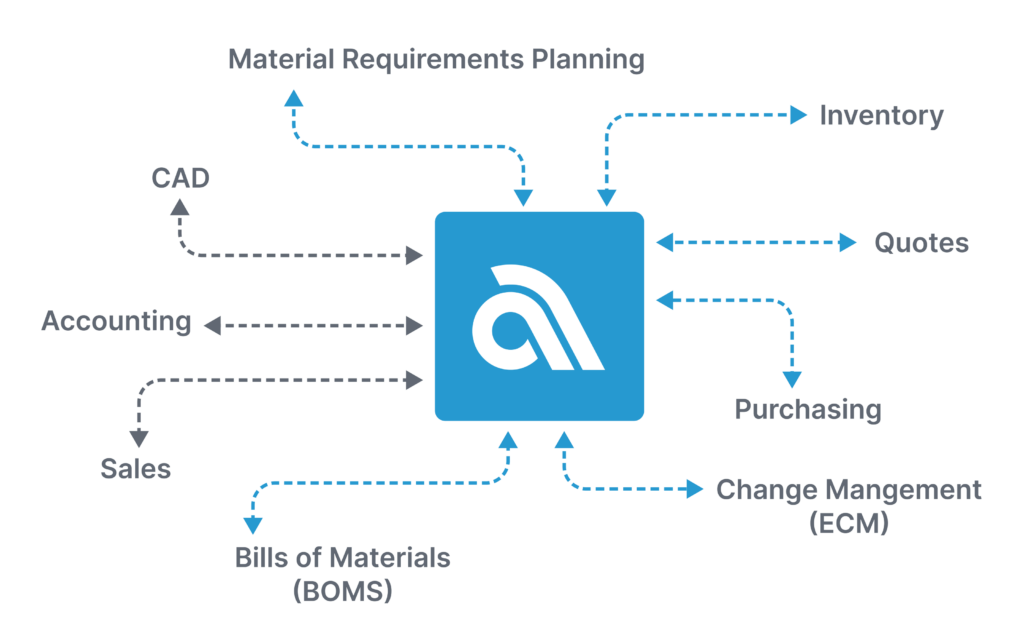

This cross-departmental collaboration is facilitated through regular meetings, data sharing, and the use of production management software like Material Resource Planning systems. By integrating the knowledge and insights from each department, the demand estimation process becomes more robust, leading to better decision-making and more efficient operations across the manufacturing organization.

What is Needed and From Whom

The demand estimation process requires a wide range of information from various departments within an organization. Each department contributes specific data and insights that are critical for creating accurate demand forecasts. Here’s a breakdown of the key information needed and who typically provides it:

1. Sales Pipeline and Forecasts

- Information: Data on leads, prospects, sales funnel stages, and expected deal closures.

- Purpose: Provides a short-term view of upcoming demand based on active sales opportunities.

- Provided by: Sales Department

2. Historical Sales Data

- Information: Past sales volumes, revenue, product performance, and customer segments.

- Purpose: Identifies trends, seasonality, and demand patterns based on historical performance.

- Provided by: Sales and Marketing Department

3. Production Capacity and Lead Times

- Information: Manufacturing capacity, production schedules, lead times, and equipment utilization.

- Purpose: Ensures that production capabilities align with forecasted demand, avoiding capacity constraints or inefficiencies.

- Provided by: Operations and Production Department

4. Inventory Levels and Turnover

- Information: Current inventory levels, turnover rates, stock-outs, and overstock data.

- Purpose: Ensures inventory levels are aligned with demand forecasts, preventing overproduction or stock shortages.

- Provided by: Supply Chain and Inventory Management Department

5. Supplier Performance and Material Availability

- Information: Supplier reliability, lead times, costs, and material availability.

- Purpose: Ensures that the supply chain can support forecasted demand, particularly for raw materials and components.

- Provided by: Procurement and Supply Chain Department

6. Operations Efficiency and Metrics

- Information: Production cycle times, efficiency rates, waste levels, and resource utilization.

- Purpose: Ensures that manufacturing processes are optimized to meet demand forecasts efficiently.

- Provided by: Operations Department

7. Financial Targets and Budgets

- Information: Revenue targets, cost forecasts, and overall budget allocations.

- Purpose: Aligns demand forecasts with the company’s financial goals, ensuring forecasts are realistic and financially viable.

- Provided by: Finance Department

8. Competitive Analysis

- Information: Data on competitors’ pricing, product launches, and market share movements.

- Purpose: Helps anticipate market shifts due to competitive pressures and informs adjustments to demand forecasts.

- Provided by: Marketing and Sales Departments

9. Market Research and Trends

- Information: Market conditions, customer preferences, competitor analysis, and industry trends.

- Purpose: Helps understand external factors that influence demand, such as shifts in consumer behavior and competitive actions.

- Provided by: Marketing Department

10. Customer Feedback and Satisfaction

- Information: Customer satisfaction scores, product reviews, complaints, and return rates.

- Purpose: Provides qualitative insights into customer needs and potential demand for product improvements or new features.

- Provided by: Customer Service Department

11. New Product Launches and R&D Insights

- Information: Timelines for new product launches, product enhancements, and innovation trends.

- Purpose: Anticipates demand changes due to new product introductions or technological advancements.

- Provided by: Research and Development (R&D) Department

The Case for Centralizing Demand Estimation Data

Colocating all the information related to demand estimation helps ensure data accuracy and consistency across the organization. When data from different departments—such as sales, marketing, finance, and operations—is stored and managed in a unified system (an MRP system, for instance), it reduces the risk of discrepancies and errors that can occur when information is siloed. A single source of truth allows all departments to work with the same data, leading to more reliable and consistent demand forecasts. This consistency is vital for making informed decisions that align with the company’s strategic objectives.

Retaining all relevant information in one location enhances collaboration and communication among departments. Demand estimation is a cross-functional process that relies on input from various teams, each providing critical data and insights. When this information is easily accessible in a centralized system, it facilitates smoother communication and more effective collaboration during the forecasting process. Teams can quickly share insights, validate assumptions, and make adjustments in real-time, leading to a more agile and responsive demand estimation process. This collaboration helps ensure that the forecast is comprehensive, taking into account all relevant factors, and is more likely to be accurate.

Lastly, centralizing information in one location improves efficiency and decision-making speed. With all data consolidated, there is no need to spend time gathering information from multiple sources or reconciling conflicting data sets. Decision-makers can quickly access the latest data, analyze trends, and respond to market changes more rapidly. This efficiency is particularly important in today’s fast-paced business environment, where the ability to react quickly to changes in demand can provide a significant competitive advantage. Centralized data management also supports advanced analytics and forecasting tools, enabling more sophisticated demand estimation techniques that can further enhance accuracy and business performance.

Scheduling Demand Estimation Processes: An Example

Executing a successful demand estimation process involves planning the activities in a timeline that aligns with the organization’s overall business planning cycle. Here’s how the demand estimation process might be scheduled over the course of a year:

Q4 of the Previous Year (October – December)

1. Strategic Planning and Goal Setting

October: Senior management sets overall business objectives for the upcoming year, including sales targets, product launches, and market expansion plans.

Mid-October: Cross-departmental meetings are held to communicate strategic goals and align on the demand estimation process.

2. Data Collection

November: The sales and marketing teams begin collecting historical sales data, market research, and customer feedback.

Mid-November: The finance team gathers economic indicators and reviews external market forecasts.

Late November – Early December: Customer service and R&D teams provide feedback on customer preferences and product development timelines.

Q1 (January – March)

3. Quantitative and Qualitative Forecasting

January: The management team compiles available historical data and sales estimates into projections for analysis and forecasting. This is augmented with qualitative projections from expert opinions from inside and outside the organization.

Late January: Initial demand forecasts for each product are developed.

4. Cross-Departmental Collaboration

February: Sales and Operations Planning (S&OP) meetings are held to review initial forecasts. Departments like supply chain, operations, and finance provide input and suggest adjustments.

Mid-February: Final adjustments to the demand forecast are made based on interdepartmental input.

Late February: The final demand forecast is reviewed and approved by senior management.

5. Finalizing the Forecast

March: The final demand forecast is documented and communicated across all departments. Production, inventory management, and marketing plans are adjusted based on the forecast.

End of March: Departments prepare for the implementation phase, aligning resources and schedules with the forecast.

Q2 (April – June)

6. Implementation

April: Production planning is adjusted based on the forecast, with manufacturing schedules aligned to meet the projected demand.

May: Inventory levels are managed to ensure that component stock is available for production needs.

June: Sales data is monitored closely to compare against the forecast.

Q3 (July – September)

7. Monitoring and Mid-Year Review

July – August: Real-time sales data is compared to the forecast. Any significant deviations are analyzed, and quick adjustments are made to production and inventory.

September: A mid-year review of the demand forecast is conducted. Adjustments are made to reflect demand changes, and plans are realigned for the second half of the year.

Q4 (October – December)

8. Final Adjustments and Year-End Push

October: Demand forecasts are adjusted for the holiday season.

November – December: Sales performance is monitored closely. Inventory levels are optimized to avoid stockouts or excess inventory as the year ends.

9. Year-End Review

Late December: A comprehensive review of the year’s demand estimation process is conducted. Performance against the forecast is analyzed, and key learnings are documented.

End of December: Insights from the year’s demand estimation feed into the strategic planning for the following year.

Ongoing Throughout the Year

Monthly Sales Reviews: Regular monthly reviews of actual sales data versus forecasted data are conducted. Adjustments are made as necessary, with feedback loops in place to continuously improve forecasting accuracy.

The example schedule above portrays the demand estimation as a continuous, dynamic process with regular reviews and adjustments throughout the year. It also shows the process that overlaps in execution with planning for the next year happening as the current year concludes. This helps the organization respond to changing market conditions and organizational needs in a timely manner.

The Right Tools for the Job

To perform demand estimation properly, the process typically requires the analysis of several data sets. While some firms still elect to perform this operation through in-house designed spreadsheets or even by hand, many companies rely on dedicated software to manage this task.

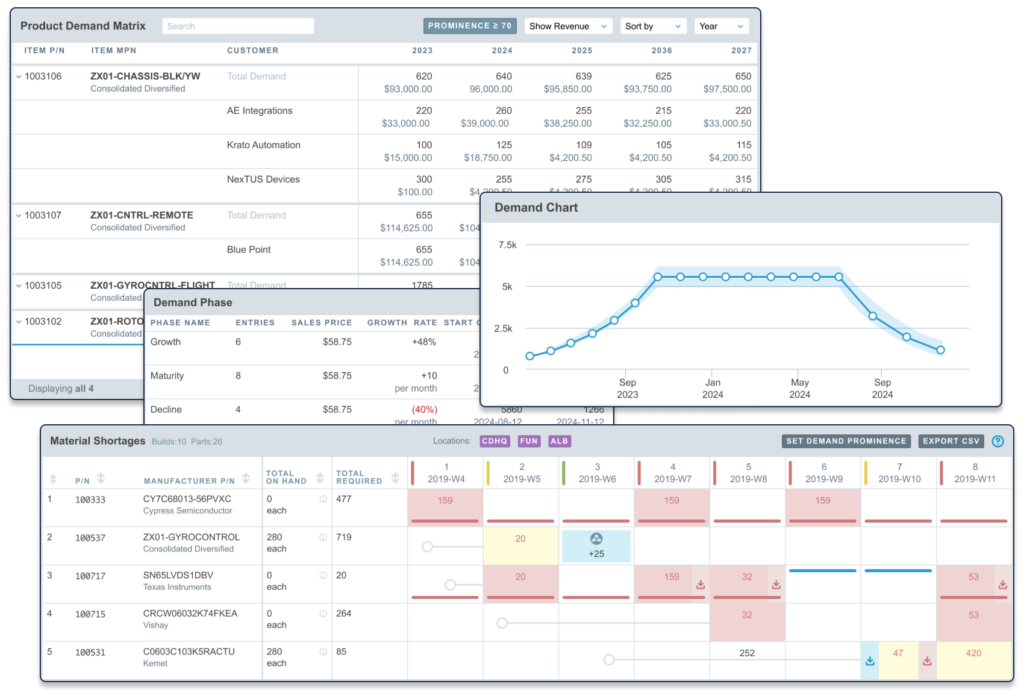

Purpose-built software like Product Lifecycle Management (PLM) or Material Resource Planning (MRP) systems like Aligni have demand estimation capabilities built in. These software systems also have the benefit of collecting and managing the information essential to the estimation process. Moving the process to software also reduces the need for human data collection, transposition, and manipulation that usually leads to errors.

Overall, demand estimation is an important part of inventory management for manufacturing products and the overall efficiency and profitability of the company. By providing accurate demand estimations, businesses can plan their inventory investments more effectively and minimize risks associated with excess stock levels. However, it is important to note that demand estimation comes with its own challenges and potential issues that must be taken into consideration before implementing a new inventory strategy.

Looking to get ahead of inventory needs for production operations? Check out how Aligni does demand forecasting or sign up today!

Start your 30-day free trial

Helping You Make Great Things…Better.